It’s important business vehicles are part of this list because the many expenses related to the use of an automobile can add up considerably. You should also include the actual production cost of the ad here. This category of business expenses should also include charges related to online display or video ads, social media, SEM (or paid search), email marketing, sponsored content and remarketing. Advertising ExpensesĪdvertising Expenses should include any amount spent on ads for your business that appear in television, newspapers, radio, print or digital magazines, billboards, and direct mail. There’s no one-stop resource that covers all potential business expenses your company might be able to deduct, but here are some of the most common expense categories that apply to many companies of all sizes.

MY GOOGLE INVOICES HOW TO

How to Categorize Expenses: 14 Common Business Expenses

Send invoices, track time, manage payments, and more…from anywhere.Īs a small business owner, you can categorize your expenses for a small business.

MY GOOGLE INVOICES SOFTWARE

Pay your employees and keep accurate books with Payroll software integrationsįreshBooks integrates with over 100 partners to help you simplify your workflows Set clear expectations with clients and organize your plans for each projectĬlient management made easy, with client info all in one place Organized and professional, helping you stand out and win new clients Track project status and collaborate with clients and team members Time-saving all-in-one bookkeeping that your business can count on Tax time and business health reports keep you informed and tax-time readyĪutomatically track your mileage and never miss a mileage deduction again Reports and tools to track money in and out, so you know where you standĮasily log expenses and receipts to ensure your books are always tax-time ready Quick and easy online, recurring, and invoice-free payment optionsĪutomated, to accurately track time and easily log billable hours

MY GOOGLE INVOICES PROFESSIONAL

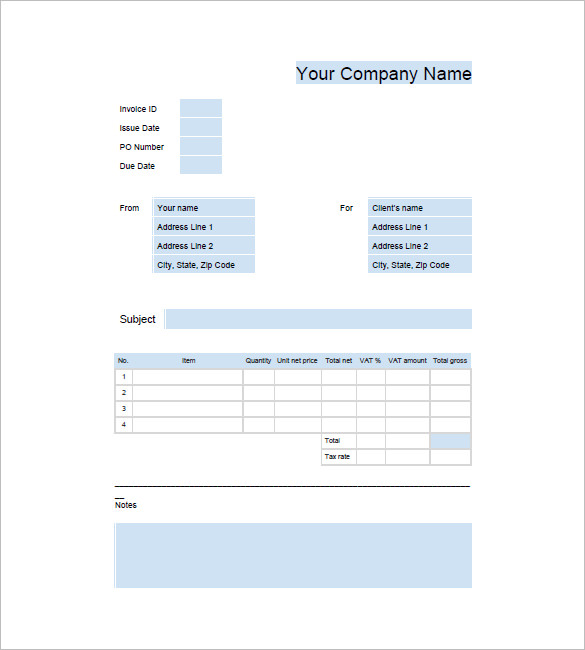

Wow clients with professional invoices that take seconds to create

0 kommentar(er)

0 kommentar(er)